Trucking companies are hemorrhaging money. Not because they’re bad operators. Because they’re drowning in manual processes and missing data.

Every day, detention happens. Layovers happen. Fuel surcharges apply. These are chargeable events—the industry calls them accessorial fees. They’re money the fleet earned. But most of it never gets collected.

The data is grim. According to industry research, only 30% of fleets even bill for these charges. Of those 30%, only 50% actually collect what they’ve invoiced. That’s a 15% effective capture rate. On a trillion-dollar industry, that means roughly $18 to $28 billion in annual revenue just disappears.

Sam Titus saw this problem a decade into the supply chain space. He’d started companies before. He’d seen industries change. But this gap—between money earned and money captured—felt different. It felt solvable.

Enter DockChron.

The Insight That Started It All

Sam didn’t invent the problem. He invented the shortcut around it.

“Talking to customers, I kept hearing the same thing,” he says. “Profitability is the challenge. Margins are paper-thin. Companies are going out of business.”

The culprit: how fleets tracked charges. Drivers sat in detention at a dock. They reported it to dispatch. Dispatch noted it. The fleet maybe invoiced it. The shipper maybe paid it. Every step was manual. Every step was a failure point.

“The majority of the time, trucking companies don’t even bill these charges because they have no idea what to bill for,” Sam explains. “They don’t know if the events actually happened.”

The solution was staring them in the face. Since 2017, electronic logging devices (ELDs) have been federally mandated in 99% of U.S. trucks. These devices track everything—hours of service, location, stops, idle time. The data was already being collected. It just wasn’t being used.

DockChron taps into that existing telematics data. It identifies chargeable events automatically—detention, layovers, fuel surcharges, tolls, out-of-route miles, stop-off charges, and more. It reports them back to the fleet owner. No guessing. No manual tracking. Just: “Here are the events. Here’s the revenue you’re missing.”

But DockChron does something else too. It gives shippers visibility. Instead of disputing opaque charges, shippers see exactly what happened—which facilities caused detention, where route inefficiencies occurred, which operational patterns drove costs. They gain the data to verify claims and, more importantly, to fix bottlenecks before they become expensive problems.

Why Now

The timing wasn’t luck. It was the convergence of three things.

First, fleets are under unprecedented margin pressure. Fuel costs are up. Labor is expensive. Equipment is costly. Every dollar counts.

Second, the data is mature. ELDs aren’t new anymore. Fleets trust the data. It’s reliable enough to build business decisions on.

Third, Sam’s team has the domain expertise to connect the dots. Between them: Amazon supply chain background. Nike procurement experience. Ford telematics engineering. Carrier logistics at scale. This isn’t a software team stumbling into trucking. This is a logistics team solving logistics problems with software.

“We believe the timing is just right,” Sam says. “Fleets are under tremendous margin pressure. The data is available. And we can rely on it.”

The Math Actually Works

DockChron doesn’t ask fleets to believe. It shows them.

One of their pilot customers—a smaller fleet with five to six trucks—connected their telematics and DockChron’s system. Within the first month:

- DockChron uncovered $20,000 in uncollected accessorial revenue

- The fleet verified 70% of those charges

- They invoiced them

- Result: 5-6x ROI in the first month

“This is why we’re so confident,” Sam says. “It’s an ROI tool. Once a fleet owner sees this in action, it’s very easy for them to see the value.”

The economics scale. Across their pilot data, DockChron surfaces roughly $100 in recovered revenue per truck per month. For a fleet with 50 trucks, that’s $5,000 monthly on autopilot. For a fleet with 200 trucks, it’s $20,000 monthly. All from revenue they were already earning. They just weren’t collecting it.

The goal is even more ambitious: move carriers from the current 15% capture rate to full revenue recovery. Every legitimate charge detected, invoiced, and collected. DockChron charges a flat subscription fee based on fleet size, plus 4% of recovered revenue. The math is simple: the more money the fleet collects, the more both sides win.

Defining a New Category

Most startups enter existing markets. DockChron is doing something harder: creating one.

“We’re defining a new category of tools—automation in revenue capture in logistics,” Sam says. “I’m not aware of any tool that does what we do.”

That’s a competitive advantage. It’s also a sales challenge. When you’re the first to do something, you have to teach the market what you do. You have to explain why they need it. You have to convince skeptics that the problem is real enough to solve.

But the pilots are working. DockChron has moved fleets into production. They’re seeing results. And they’re building something that solves a two-sided problem: helping carriers capture revenue and giving shippers transparency into freight bills. Both sides want cleaner, faster payment flows.

The 12-Month Play

Sam’s goal is concrete: onboard 50 to 60 more fleets by the end of 2025. Convert 50% of them into paying customers. Track the fundamental metric—recovered revenue per truck per month—and prove the model scales.

The market opportunity is massive. When you focus on the segment of carriers large enough to have billing processes but small enough that those processes are still mostly manual, you’re looking at roughly $4.7 billion in recoverable revenue sitting on the table.

One assumption could be wrong: some fleets already have automation through their transportation management systems. But Sam’s pilots show even those fleets are missing 20-40% of their charges. The problem is bigger than any single vendor’s solution.

How Project FinTech Helped

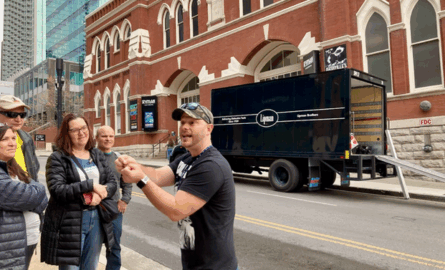

Sam chose to join the Nashville Entrepreneur Center’s Project FinTech cohort. He had options. He had experience. He’d built companies before.

“Having a group of mentors and advisors is really helping us push forward,” he says. “Starting a company is hard. Starting something new that not a lot of people are familiar with is harder.”

The program connected him with Jeff Brays, a mentor who pushed the team in strategic directions. They iterated on ideas. They got introductions—not just to investors, but to fleet owners, logistics specialists, and industry experts. In a category-defining business, that clarity matters.

What’s Next

DockChron is raising capital to accelerate product development, expand integrations with ELD vendors, and build out the sales team. The team: Sam Titus (CEO) brings years leading logistics companies and founding tech startups. Desiree Titus (CMO) draws on extensive shipper experience from Home Depot and others. Duard (D.J.) Crandall (CXO) brings 20+ years in product strategy, supply chain optimization, and digital transformation across Fortune 100s, startups, and companies like Amazon and Nike. They’ve exited companies before. They know what it takes to scale.

The trucking industry moves slowly. But when it moves, it moves at scale. Fleets make decisions deliberately. But once they commit, they commit across their entire operation.

DockChron is betting that the data, the ROI, and the two-sided value will convince them. Carriers see immediate revenue recovery. Shippers gain visibility and cost-reduction opportunities. Both sides build trust on verified data instead of disputed invoices. Everything Sam is seeing from pilots suggests they’re right.

Learn more: DockChron.com

Interested in building the next generation of supply chain solutions? Explore all of the Nashville Entrepreneur Center’s accelerator programs at ec.co/accelerators.