This content was contributed by Chris Brown, EC Member and Advisor

You only need five tools to be your own Chief Financial Officer. Forget LLCs, CRMs, and CPAs.

With these five simple tools, the modern solopreneur can focus on what matters most: generating more cash.

1. Business Bank Account

Contrary to popular belief, you do not need an LLC to open up a business bank account. Banks will let you open up a business bank account under your Social Security Number if you tell them that you file as a Sole Proprietor.

Keeping your personal finances separate from your business finances is always a good idea, for bookkeeping and for your own sanity.

2. Business Credit Card

Once your business bank account is opened, apply for a business credit card at the same bank. Put all your recurring expenses and business purchases on this credit card.

Don’t worry about the interest rate, you’ll be paying it off every month anyways.

The goal here is to begin building up a credit line with the bank so you can make larger purchases later once your cash flow increases.

3. Quickbooks Online

Quickbooks is one of the best bookkeeping softwares for small businesses. They have a great user interface and convenient connectivity to banks.

Once set up, categorize your bank transactions.

Bookkeeping will get more complex when you have multiple customers and thousands of dollars a month in sales. As you start, keep it simple.

There are many experts at Nashville Entrepreneur Center that can help set this up for you.

4. Cash Flow Forecast

Quickbooks generates a Profit & Loss statement, but that is not enough. Plan future cash inflows based on future customer deposits, as well as future purchases like expenses, supplies, and equipment.

Most solopreneurs forecast cash on a monthly basis, but sometimes weekly or even daily cash flow forecasts are necessary. On my website, you can find my beginner’s guide to cash flow templates with links to pre-built templates to get started.

5. Cash Break Even Calculator

It’s likely that you will spend more cash than you earn for the first few weeks, months, or maybe even years of starting your business. That is why it’s important to understand your cash breakeven.

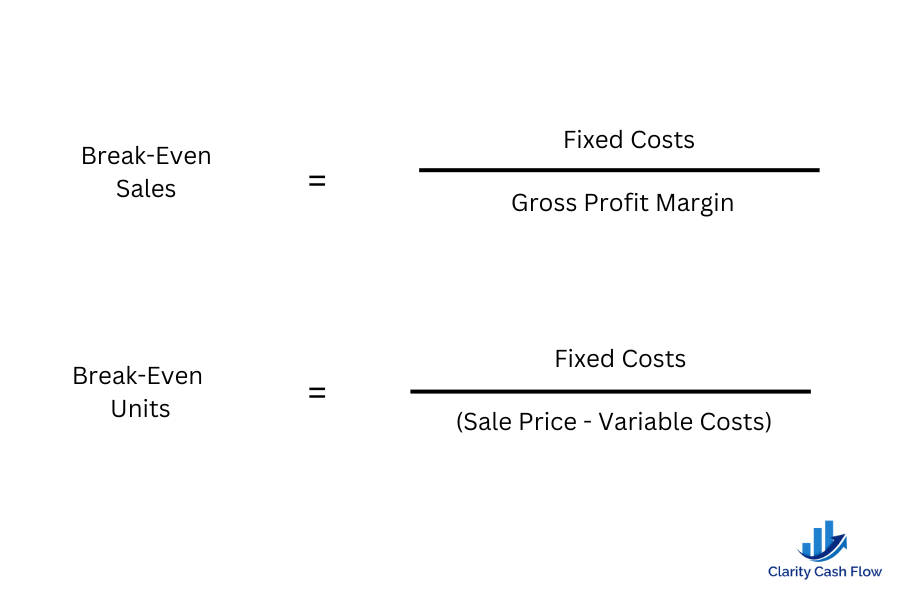

Cash breakeven can be calculated as:

The answer you get will tell you how much of your product or service you need to sell over a period of time before you can begin generating positive cash flow.

These 5 tools are very basic but will help you stay in control of your business while not wasting time on things that don’t contribute to the bottom line.

If you need more help, you can find Chris on the EC Advisor Network.

About Chris

Since 2015, Chris Brown has been a finance professional, specializing in cash forecasting, financial software, and strategic finance. He builds financial models for pre-revenue startups and supports major Fortune 500 companies with their treasury management systems. Recognized as an authority in financial strategy, Chris frequently speaks at Nashville’s Entrepreneur Center and various Small Business Development Centers (SBDCs) nationwide. For additional insights and resources, visit his website at www.claritycashflow.co.